How long does it take to recover from bankruptcy? I started to answer the client’s question before I realized that the question was all backward. Recover FROM bankruptcy? No…. It should be: recover THROUGH bankruptcy! Bankruptcy is the tool for recovering from impossible financial situations. The ailment is debt: bills in excess of what you […]

Can Debt Discharged In Bankruptcy Come Back To Haunt You?

Can debt bankruptcy in bankruptcy come back to haunt me? Worried clients ask me this all the time, fearful that the relief they get from their creditors in bankruptcy is only temporary. The short answer is no. The automatic stay that stops collectors when you file bankruptcy is replaced, at the end of the case, […]

Bankruptcy Changes Your Life, Only Not The Way You Think

How will filing bankruptcy change my life? My clients ask all the time. They imagine the remainder of their life after bankruptcy with neither credit cards nor credit. Outcasts in our economy. Shunned by all. Crippled by bankruptcy. They can see a scarlet “B” tattooed on their foreheads to mark them forever as Bankrupts. My […]

Can You Get A Car Loan After Bankruptcy?

Wheels are essential for most of us to get to work. And whatever you’re driving when you file bankruptcy will need to be replaced at some point. So, how are you going to finance that next car if you’ve just filed bankruptcy and face 7-10 years with the bankruptcy on your credit report? The credit […]

Life After Bankruptcy: What’s It Really Like?

What’s life really like after bankruptcy? Everyone suffering through financial difficulties wants to know whether filing bankruptcy just trades one form of pain for another. Will you be shut out of the American dream forever? Unable to function in a world centered on electronic payments? Here’s a collection of our best stories and advice on […]

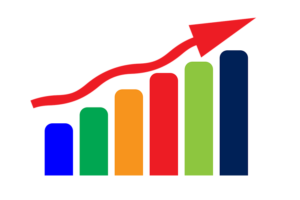

Bankruptcy Drives Credit Score Surprise

Bankruptcy improved my client’s credit score, almost on the spot. Before bankruptcy, a miserable credit score was no surprise. This client reported a 498 credit score before he filed. What was surprising is that, three month after he filed bankruptcy, his score was 614! That’s a 116 point increase in his score in three months. […]

Damaged Credit Heals

Will filing bankruptcy hurt my credit? Probably. [Keep reading, there’s more.] Should that hit to your credit keep from filing bankruptcy? Not by a long shot. Incredibly, I encounter people drowning in debt who think their credit report is more important than their financial health. Their thinking seems to be that credit, once damaged, is never […]

Rising From The Ashes Of Financial Disaster

Life doesn’t end with bankruptcy. Bankruptcy doesn’t mean that the good times are all in the past. There’s the future, too. Both the individual and society reap benefits from bankruptcy in ways that you may have missed. So, in my view, Jay Fleichman’s analysis of the bankruptcy of Halsey Minor, the founder of CNET and once […]

Your Right To Credit Reporting After Bankruptcy

You’ve finished your Chapter 13 and emerged from bankruptcy with your home loan current. But your credit report is a blank page as to your mortgage. The mortgage servicer isn’t reporting your payments to the credit reporting agencies [CRA’s]. Nothing. Nada. Crickets. So, even though you’re making regular payments, you’re not visibly rebuilding your credit. […]