The old saw about Oakland, California is that there is no “there” there. I suggest it’s the same about being “in foreclosure”: foreclosure is not a place, it’s a path. Nothing legally meaningful changes until you get to a foreclosure sale. Everything before that is prelude. Yet several Bay Area clients have asked whether they can remove personal […]

Search Results for: do you need to file bankruptcy

So You Keep Your Home Through Bankruptcy- What Then?

What happens to your home after your bankruptcy case is over? Most people who file bankruptcy are terrified that just filing bankruptcy will cost them their home. They won’t let me keep my home, will they? Sure they will. The Chapter 7 bankruptcy trustee doesn’t want the house if there’s no value in it, He’s […]

Why Keep Bankruptcy Off Your Credit Record

We’ll help you do your own bankruptcy, promises the ad. And for a few dollars more, we’ll sell you the secret to keep your bankruptcy off your credit record. That pitch plays neatly into the obsession that we have about our credit reports. Even when your financial world is upside down. But this pitch has it […]

If The IRS Comes Calling After Your Bankruptcy Discharge

It’s scary, or infuriating, when the IRS continues to try to collect taxes discharged in bankruptcy. What was the point of filing bankruptcy if the government ignores your discharge? Yet IRS attempts to collect taxes from people with a bankruptcy discharge form the single largest group of cases in my law office today. Why the […]

Creditor Must Pay If It Loses A Bankruptcy Fight

The game isn’t very fair when the players are mismatched. Though bankruptcy court is hardly a game, it’s been unfair when it comes to attorneys fees for the winning party. California law provides that when a contract allows one party their fees if they prevail, the other party got their fees if they won. So, […]

Audited? Did You Tell The State Tax Authorities?

We’re all about sharing these days, aren’t we? So, did you share with the state tax authorities the outcome of your IRS audit? While telling the Franchise Tax Board that you owe more taxes to the feds may seem like inviting trouble, you gain by doing so. How? You set those taxes owed to California […]

Spot Credit Report Errors After Your Bankruptcy & Fix Them

Your debts have been discharged in Bankruptcy. Congratulations! But if those debts still appear on your credit report, you haven’t gotten all the debt relief you are entitled to. Your credit report is the public face of your finances. It’s the thing that lenders, landlords, and life insurance companies look at to figure out whether […]

Why Bankruptcy Cases Go Down The Drain

I watched dozens of Chapter 13 bankruptcy cases get dismissed in a single afternoon in court recently. Dismissed. Tossed out. Ended. The usual reason was that the debtor had not taken seriously the requirement that all their tax returns be filed within 45 days of the commencement of the case. Regardless of the debtor’s need […]

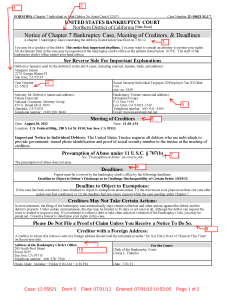

Ten Essential Nuggets For Creditors in Bankruptcy Notice

You’re looking at bankruptcy official form B9. It arrived in your mail because someone has filed bankruptcy and listed you as a creditor on the schedules of a newly filed bankruptcy case. Most likely, the debtor owes you money or you have an open claim of some sort against the bankrupt. Your rights against the debtor […]

Will A Second Bankruptcy Really Protect?

Immediate protection from collection is at the top of the list for most bankruptcy filers. They want the lawsuit to stop; the wage garnishment to stop; the debt collectors to stop. But, if this isn’t your first bankruptcy case, do you get that protection? What the automatic stay does The Automatic Stay (or “Stay”) protects […]

- « Previous Page

- 1

- …

- 16

- 17

- 18

- 19

- 20

- …

- 28

- Next Page »