The ground has shifted under California real property law.

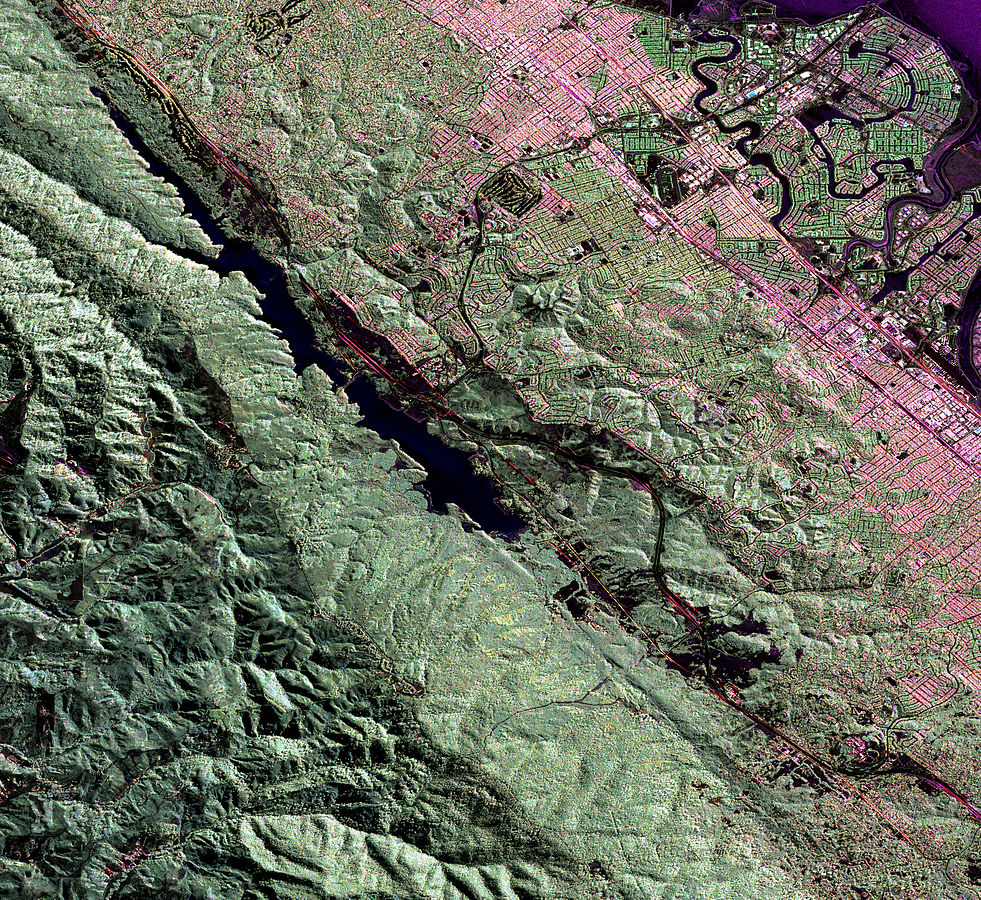

The change looms as large as a quake along the San Andreas fault that runs through our neighborhood.

The words on a real property deed no longer mean exactly what they say when the property owners are married to each other.

The newly decided Brace case holds that the presumption that property acquired during marriage is community property trumps the form of title expressed in the deed.

Under this decision, spouses who take title to real estate as “husband and wife, as joint tenants” hold that property as community property, not the separate property that follows from the form of title, unless they’ve taken another step.

That other step requires a written agreement, expressly transmuting the property from community property to the separate property of each spouse.

trans·mute-change in form, nature, or substance.

Without getting too geeky, Brace addressed the collision between two statutory presumptions in California law.

One presumption says that the form of title expressed in a deed controls the characterization of the property, in the absence of evidence that it’s really something else. So, if the deed says we’re joint tenants, and California law says that joint tenancy is a form of ownership distinct from community property, then the property is our separate property, even if we’re married.

The competing presumption says that property that a married couple acquires during marriage is community property. So which presumption wins when married folks acquire property during marriage taking title as joint tenants?

The Brace decision says that the community property presumption wins: the property is community property.

Why characterization matters

A central tenant of California community law is that all of the community property of a married couple is liable for the debts of either spouse.

If we’re married, my half of the marital community can be seized by your creditor for a debt I have nothing to do with.

In bankruptcy, if one spouse files bankruptcy, all of the community property of the marriage comes into the bankruptcy estate . The bankruptcy trustee can sell all non exempt property to pay creditors of the community.

Tremors caused by Valli decision

Until Brace, the bankruptcy community turned to the 9th Circuit’s decision called Summers, applying California law to a bankruptcy governed by federal law. Summers held that the title presumption in the deed by which spouses acquired real property was effective to show their intention to hold the property as the separate property of each spouse.

Then the California Supreme Court decided Valli, determining that when Rudy bought a life insurance policy during marriage and took title in his wife’s name, his decision to give her title wasn’t effective to defeat the community property presumption. That was so, the court said, even though Rudy was the spouse who gave up his interest in what would otherwise be community property.

When the Valli’s divorced, Rudy claimed the insurance policy was community property, and eventually won.

The question in the bankruptcy context has been whether the presumptions that operated in divorce carried over to debtor/creditor rights in California property where there was no divorce involved.

The Brace decision says it does.