A prospective bankruptcy client often arrives in my office they’ve been sued for debt and they are panicked about the consequences.

Almost invariably, the client has leapt to two incorrect assumptions:

- the world as they know it is coming to an end; and

- they don’t have to do anything until the date set for the case management conference, months down the road.

Wrong on both counts.

Judgments take time

Nothing adverse is going to happen immediately.

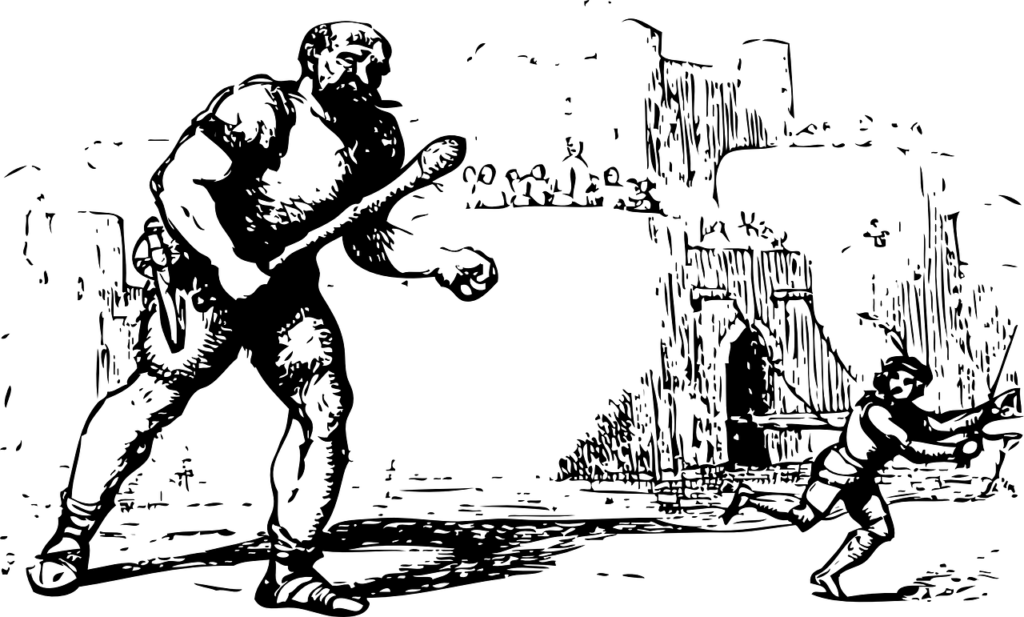

The filing of a lawsuit is a step toward a legal judgment in favor of the creditor. A judgment is a determination that the debtor owes the amount of the debt and usually the creditor’s expenses to get the judgment.

A judgment entitles the judgment creditor to enlist the coercive power of the state to collect that judgment by levy, lien or garnishment.

All about California judgments

Judgment liens

A judgment in California does not automatically constitute a lien on the debtor’s assets, as it does in some states.

In California, a creditor with a judgment must take an additional step to create a judgment lien.

A judgment lien on real estate is created when an abstract of judgment, issued by the court after entry of judgment, is recorded in the records of the county recorder.

A judgment lien on personal property is created by filing a notice of judgment with the Secretary of State.

A judgment lien allows a creditor to execute on that lien through the courts. In that process, even outside of bankruptcy, the judgment debtor may claim an exemption in certain kinds of property.

In short, getting a judgment is just a step toward actually taking something from the judgment debtor. All these steps take time and cost the creditor something.

Time to consider your options

The filing of a lawsuit may be a good indicator that you need to do something proactive about your financial situation but it is not an emergency.

About that second assumption, that you don’t need to act before the court date, you must read this.

More

California judgments are dischargeable in bankruptcy

Do you need to file bankruptcy

What’s the difference between a good bankruptcy lawyer and a great one?

[…] between individuals and business entities are civil matters. An unpaid debt can be enforced through the civil courts, where the lender sues the borrower. The government is not a party to the suit; government merely […]