Incorporate to protect yourself from the debts of your business, shriek the ads. That’s the theory of incorporation for business: create a separate legal entity in the form of the corporation. Let that entity incur debt and expose itself to other risks. If it fails, the personal holdings of the owners of the corporation are […]

What Small Business Needs From Government

This post was first published 10 years ago, in the midst of the Great Recession. I continue to think about the real challenges of running a small business and the balance needed between simplicity for the business owner and protections for the public. More below. Senator McCain this morning on Meet the Press reprised […]

Sign Your Corporation’s Name So You Aren’t On The Hook

John Hancock knew how to sign his name- so large that King George could read it without his glasses. But could he sign for a corporation as effectively? Most small business folks who do business today as a corporation are clueless when it comes to signing contracts on behalf of their corporation. When they sign […]

Silicon Valley Horror Story: The Business Credit Card That Bit

I’ve long said that there is no credit card for which a real, live human being isn’t liable. (That may be an exaggeration, but not by much.) And I’ve long worried about the prospects for success of business startups financed on credit cards. But I’ve never seen a departing employee of a start up stuck […]

5 Small Business Mistakes That Thwart Success

In recognition of National Small Business Week, we look at what a bankruptcy lawyer knows about business. Everyone tells you what to do to succeed in business; you also need to know what not to do if you don’t want to fail. Running your own business is the classic American dream. It’s romantic and heroic. […]

How Guarantors Can Escape Tax On Soured Debt

Tax lawyer Bill Purdy and I shared a client with a small interest in a failed corporation with a huge SBA loan. Could our client escape the tax consequences should we be able to settle his liability on a million dollars in unpaid loan. Was the client looking at a million dollars of cancellation of […]

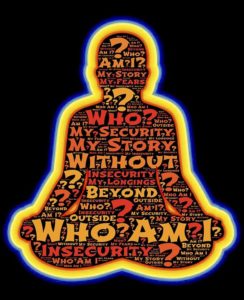

Business Bankruptcy Depends On Who You Are

While knowing who you are may be central to philosophy and mental health, you wouldn’t think it poses a difficult question in a business bankruptcy. You wouldn’t think the word “you” would be so challenging. Yet, small business owners find it hard to separate themselves from the business, even when that business is incorporated. After […]

Tax Filing Extension Invites Tax Trouble For The Self Employed

We never make tax deposits for our small business because we don’t know what we’ll owe. We just wait til the return is prepared and try to pay then, he explained. But, again this October, he couldn’t write a tax check for a year’s worth of income. So the client sitting across the table from […]

Three Cheers For Entrepreneurs

Let’s hear it for entrepreneurs. Those brave, tireless people with a dream who start or run small businesses. They possess more energy and perseverance than most of us. They form the backbone of our economy. In honor of National Entrepreneurs Day, November 20th, let’s recap Soapbox’s best on being in business for yourself. It’s probably […]

How Your Property Gets Sold In Your Partner’s Bankruptcy

It isn’t just marriage that can get you roped in to a bankruptcy case that isn’t your own. Own community property and a bankruptcy filing by your spouse or your soon-to-be ex can drag you into a bankruptcy court. But the issue is broader: joint ownership of any kind of asset in any state, community […]