Any time you can double your retirement savings and protect your money from creditors is a good time of the year. The period between New Years and Tax Day is my favorite time of the year, just for that reason. You can make contributions to your IRA last year AND contribute to this year’s IRA […]

Got A 1099? How To Avoid Paying More Tax

One of life’s persistent gotcha’s is the tax consequence of having debt forgiven. Did you compromise a debt, eliminate it upon foreclosure, or have your creditor simply wipe it out without payment. You may have a tax problem. The tax code treats the forgiveness of debt as income, even though you never saw a penny […]

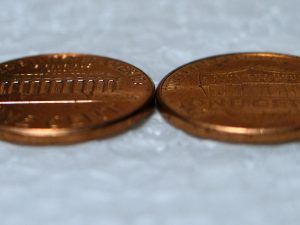

Five Tax Tips For Two Cents

The tax filing deadline approaches. So why is a bankruptcy lawyer talking about taxes? I’ve found over three decades as a bankruptcy lawyer that there’s a surprising degree of overlap between bankruptcy and tax . All too often, it’s tax troubles that brings a family to me for help. Here’s my two cents on what […]