California Bankruptcy law is a lot like a unicorn….appealing but imaginary. Instead, we have bankruptcy in California, where the landscape is shaped by community property; state exemptions, large mortgages, and the 9th circuit court of appeals. Like the Merced River cutting through the granite of Yosemite, those factors alter the bankruptcy landscape here. Community property […]

Chapter 13 Dismissed After All Payments Are Made: Self Inflicted Wounds

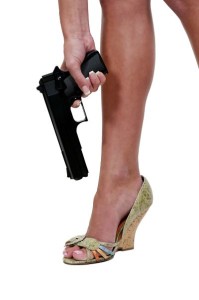

There’s been a rash of bullet-ridden feet lately in Chapter 13 cases. Debtors seem to whip out their pistols and shoot themselves in the foot with increasing regularity. Just when their goal of keeping the house was within reach, had they paid attention, they lose it all. It happens when debtors don’t hold up their […]