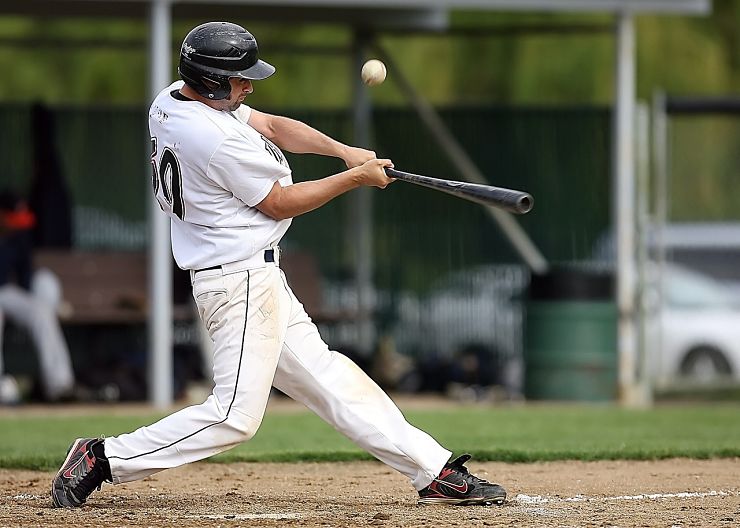

Three strikes and you’re out. Anyone familiar with baseball knows that one.

The rules are different in bankruptcy.

Two strikes and you’re out.

And for one couple, they’re not only out of bankruptcy, they’re out of their house.

Foreclosed the day after they filed bankruptcy number three.

Because, what they didn’t know is that there is no automatic stay of foreclosure in a third bankruptcy filing.

Without a lawyer, they gambled and lost.

Bankruptcy reform is cruel

When Congress “reformed” bankruptcy law a decade ago, it limited the availability of the automatic stay in cases where the filer had repeat bankruptcy filings.

Under the new law, the stay is automatic in a first case; lasts for 30 days in a second case; and doesn’t exist at all in a third case. See 11 U.S.C. 362(c)(3).

The rule looks at cases pending during the year and dismissed in the twelve months before the case at hand.

The change was intended to stop abuse of bankruptcy law by folks who filed bankruptcy only to get the stay of collection, folks who didn’t intend to follow through with a complete filing in accordance with the rules.

And certainly, there are a few examples of deliberate abuse of the law.

What they didn’t know about repeat bankruptcy filings

The elderly couple in this story wanted to put off the foreclosure long enough to sell their home. For reasons I haven’t figured out, with their house on the line, they opted to file a Chapter 13 without the help of a lawyer.

In each case, they filed a “skeleton” case, the bare bones necessary to initiate a bankruptcy case.

And in each case, they failed to file the balance of the schedules within the two week extension provided by the rules.

Under the “reformed” statute, a repeat bankruptcy filing of their third case within the last 12 months didn’t trigger a stay against foreclosure.

So, when the lender foreclosed the day after they filed the third case, the lender was good under the law.

And the house was gone.

Do it yourself is dangerous

Usually, we admire the independent, the tenacious, the resourceful. We applaud the do-it-yourself ethic.

But law is not like carpentry or car maintenance.

Like it or not, law is complicated, rule-driven, and often inflexible.

Having to file again because you didn’t follow the law isn’t a successful game plan.

I know, hiring a lawyer seems particularly painful when the problem you need to solve is not enough money.

But the pain of paying for help is minor next to losing your house, unnecessarily.

Bankruptcy lawyers are used to clients with few funds. Chapter 13 provides a way to legally pay your lawyer after you file your case. We can often find a way to make it work.

In many ways, bankruptcy is a team sport: you and your lawyer. Victory is unlikely when you take the field short-handed.

More

The multi-million dollar DYI case

How much should bankruptcy cost?

Timeline for foreclosure in California

How to interview a bankruptcy lawyer