Fear follows debt, like a shadow follows you. People in debt are afraid of the caller on the phone. They are afraid of the process server. They are afraid of the truth getting out. Yet, they fear bankruptcy more, apparently. They seem to fear that life as they know it will end if they file […]

Will Social Security Be Enough To Retire To Surf City?

We live in the Golden State. Retirement is supposed to be the Golden Years. Do you have enough gold to make it happen? It takes more than twice the typical Social Security check to meet just basic living expenses for a single elder in Santa Cruz County. Yup, the median Social Security check is $12,500 […]

What’s To Fear About Bankruptcy

Fear of filing bankruptcy keeps countless people mired in debt. Are you one of them? On Halloween, we indulge in mock horror and seek out the thrill that comes with a little fear. When it comes to getting relief from bills you can’t pay in bankruptcy, the fear isn’t such fun. It stands in the […]

Does Filing Bankruptcy Ruin My Credit For 7 Years

Will filing bankruptcy ruin my credit for seven years? I heard this again from a bankruptcy client this week. The only seven year debt forgiveness reference I can find is in the Old Testament: “Every seven years you shall forgive them their debts.” Bankruptcy has to be removed from your credit report after ten years. You […]

Free Retirement Advice By Professional Advisor Comes Up One Tool Short

The 65 year old woman featured in the newspaper’s Money Makeover series got a free review of her financial situation by a professional financial advisor. Over her working lifetime, she’s been the source of financial support for an extended family, including her aged mother and a disabled sister. Her aid to her family has come […]

Filing Bankruptcy Is All About Your Future

The decision to file bankruptcy is usually driven by threats from creditors to take something from you, now. Do nothing and your creditor can levy your bank account or garnish your wages. More about how lawsuits work It’s all too human to put off a difficult step like filing bankruptcy until those threats seem real and […]

Even The Rich & Famous File Bankruptcy

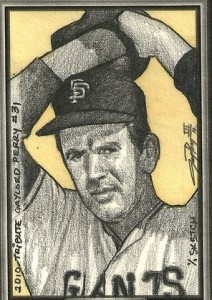

ESPN tweeted the names of some 60 professional athletes who have filed bankruptcy and asked which names surprised the Twittersphere. Included were Johnny Unitas, Bernie Kosar, Mike Tyson, Dorothy Hamill, Gaylord Perry of my very favorite baseball team, and Roscoe Tanner, from my very favorite university. While titillating reading, none of them surprised me. Bankruptcy is not […]

Miracles Possible in Mortgage Mess

INVOKE THE SECOND DIVINE MIRACLE OF THE VANISHING EQUITY Why Many Homeowners Need to Run, Not Walk, to Bankruptcy Court and File for Chapter 13 Bankruptcy. The world has many sacred sites. Places that inspire great faith. Places where people go to express, renew, and sometimes discover their faith. Rome, Mecca, and the Holy Land […]

Changing view of when to file bankruptcy

The Supreme Court’s recent decision in Lanning and the application of the infamous “means test” to a client’s changing income picture has changed my advice about when to file bankruptcy. My standard advice to clients newly unemployed who see clearly they won’t be able to pay their existing bills has been to wait. Wait until […]

What happened to encouraging Chapter 13

Used to be, bankruptcy law was organized to encourage debtors to file Chapter 13 and repay some part of their debts. Some part of that encouragement came in the form of the Super Discharge: the ability to discharge debts incurred by bad acts; unfiled tax debt from long past tax years; and unfiled claims in […]

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- Next Page »