What kind of life style are you entitled to?

When was your sense of your place in the economic world formed? For a significant slice of us, decades ago.

Just like the anti virus software on our computers and the operating systems on our smart phones, our mental software about our money needs an update.

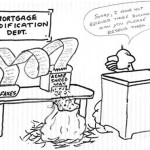

Outdated financial expectations

My theory: our view of how middle class people live needs an update.

We need Version 2.0 of our internal software on personal finance and our place in the economic world, if you will.

An update that takes into account changes in the world since we were kids, feeling our way through a consumer economy.

Changes like wage stagnation, off shoring, fewer pensions, and longer post retirement lives. Not to mention the sheer increase in the cost of living.

I see sticker shock about the cost of living writ large in Silicon Valley. Highly skilled people drawn here by the vibrant entrepreneurial ecosystem are unprepared for the high cost of housing, and, really, everything. They used credit to bridge the gap between what they earned and what a middle class life here costs.

We have an ingrained sense of the niceties that should come with a college education and a steady job. We acquire those niceties because, well, they’re nice, and we’re entitled by reason of job, education, or age. Credit makes it possible.

That sense of the creature comforts that come with our status hasn’t been meaningfully revised to incorporate the changes in the American economy.

As a group, we’re unwilling to accept that we can’t live the comfortable life we’re programmed to expect on the money we earn. We seem particularly unprepared to spend less now so we can live decently in our old age.

We’re adrift in a sea of consumerism without modern navigational tools.

Lifestyle Convergence

One thing I’ve learned helping people get out of debt for 40+ years is how much the apparently distinct ideas of

- intentional simplicity;

- living ecologically; and

- balanced spending

all lead to the same kind of life style.

Check your internal personal finance “software” and see if it’s time to update to a more modern version.

Change can be difficult, but not changing is dangerous.

Image courtesy of Pixabay.