Business owners with unpaid payroll taxes are in deep trouble.

Even if the employer is a corporation, the corporation’s managers are personally liable for the trust fund portion of unpaid payroll taxes. There’s no corporate shield when it comes to payroll taxes.

The trust fund portion of the tax (the amount withheld from employees’ checks) can be assessed against anyone who could have paid that money to the IRS.

You are in the IRS’s cross hairs, personally, if the business hands out “net” checks to employees without sending the withheld money in. A bankruptcy discharge is no help here.

What’s the payroll tax

What we refer to as “payroll tax” is really a combination of two elements: the employee’s income and FICA taxes that the employer has withheld and the employer’s share of FICA (Social Security) tax.

The portion of the “payroll tax” withheld from the employee’s check are the “trust fund” portion of the payroll tax. Usually, trust funds make up about 2/3rds of the payroll tax. The balance is the business’s matching contribution to Social Security.

The liability of corporate officers or LLC managers for the business’s trust fund liability is not dischargeable in bankruptcy. Like other federal taxes, the statute of limitations is 10 years and the IRS is a fearsome creditor.

Earmark tax payments

If you find yourself in this pickle, you, and the business itself, can bail yourself out of trouble with an earmark of any payment you make toward Form 941 liability.

A taxpayer who makes voluntary payments to the IRS has the right to designate to which liability the payment will be applied. In re Ribs-R-Us, Inc., 828 F.2d 199, 201 (3rd Cir. 1987).

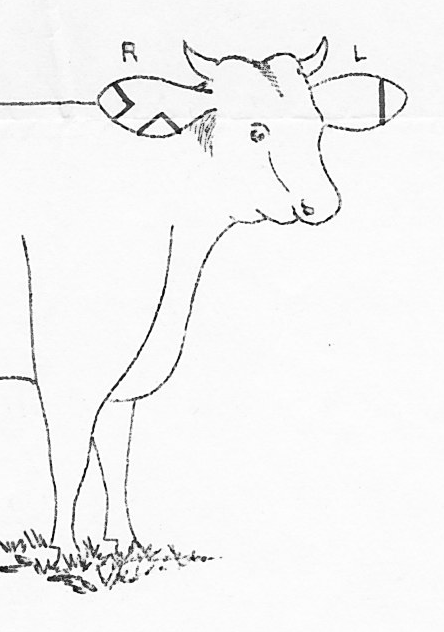

An earmark allows the IRS to distinguish your payment from others, like a cropped ear lets a cattleman tell his cows from his neighbors.

It is simply a direction to the IRS as to how the payment is to be credited. Pay voluntarily and you have the right to tell the IRS what to do with the money.

Without instructions, the IRS is free to apply payment it receives on the tax debt as it chooses. And it chooses the manner of application that benefits it best.

Send a check for payroll taxes and if the check is not enough to pay the entire liability, the IRS applies it first to the dischargeable portion of the tax first, preserving the personal liability of the business owners for the remaining tax.

Likewise, if the IRS levies an account, they may apply the levied funds as they wish.

How to earmark

If the business finds itself with insufficient funds to pay the entire tax owed, you can reduce your personal liability for the unpaid tax by earmarking the payment.

Write directions on the check specifying how the payment is to be applied like this: Trust Fund liability, 4th Quarter 2015 941. Send a cover letter with the check with the same instructions. Keep a copy of the letter for your records.

Of course, the better course of action is to remain current on payroll taxes.

Use a payroll service that won’t cut the checks unless the taxes are paid, or make a tax deposit with each payroll.

Dip into the money withheld from employees and you’ve taken a “loan” that lives very nearly forever.

More

The easiest business loan in town-not

Is it safe to file a corporate bankruptcy