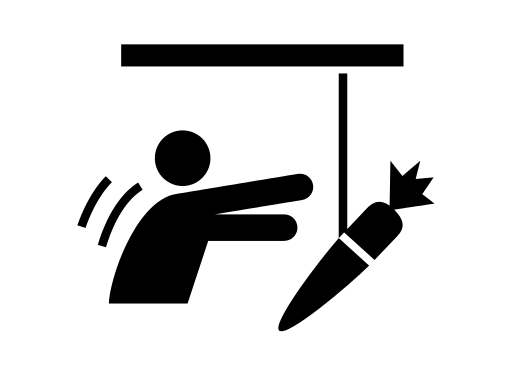

Debt settlement is often dangled in front of the financially challenged as an alternative to bankruptcy. Sounds good: making a deal with your creditors has enormous appeal when you can’t pay everything that you owe. And debt settlement companies count on it. The pitch for “settling your debts” touches a nerve. Almost everyone WANTS to […]

Northern California Bankruptcy Lawyer

On The Bankruptcy Soapbox