Whether the news comes by phone or mail, the notice that your soon-to-be-ex spouse has filed bankruptcy can bring fear and confusion.

You need some facts and a plan, now.

So let’s look at how bankruptcy affects a non filing spouse and how to chart a course through a STBX bankruptcy case.

Child support safe from bankruptcy

Regardless of the bankruptcy chapter, the debtor’s obligation for child support, spousal support or family support cannot be discharged in bankruptcy. When the bankruptcy is over, unpaid debts for support live on.

Not only is support non dischargeable, it has the first priority for payment from any funds distributed to creditors in bankruptcy.

In bankruptcy lingo, support is called a “domestic support obligation”. Whatever it’s called, it can’t be wiped out in bankruptcy.

Automatic stay halts only some proceedings

When a person files bankruptcy, an injunction against collection of existing debts automatically takes effect. But there are exceptions for many kinds of actions arising in family law.

Not affected by the stay are proceedings

- to establish or modify support

- touching custody or visitation

- to dissolve the marriage

- to address domestic violence

- to collect support from funds not property of the estate.

So, effectively the division of property becomes the biggest issue affected by the automatic stay. Proceedings in family court touching property must halt, until either the bankruptcy is closed or you get relief from the stay from the bankruptcy judge to go forward.

Community property in a one-spouse bankruptcy

Filing bankruptcy brings all of the filer’s assets, tangible and intangible, into the bankruptcy estate, potentially to pay creditors.

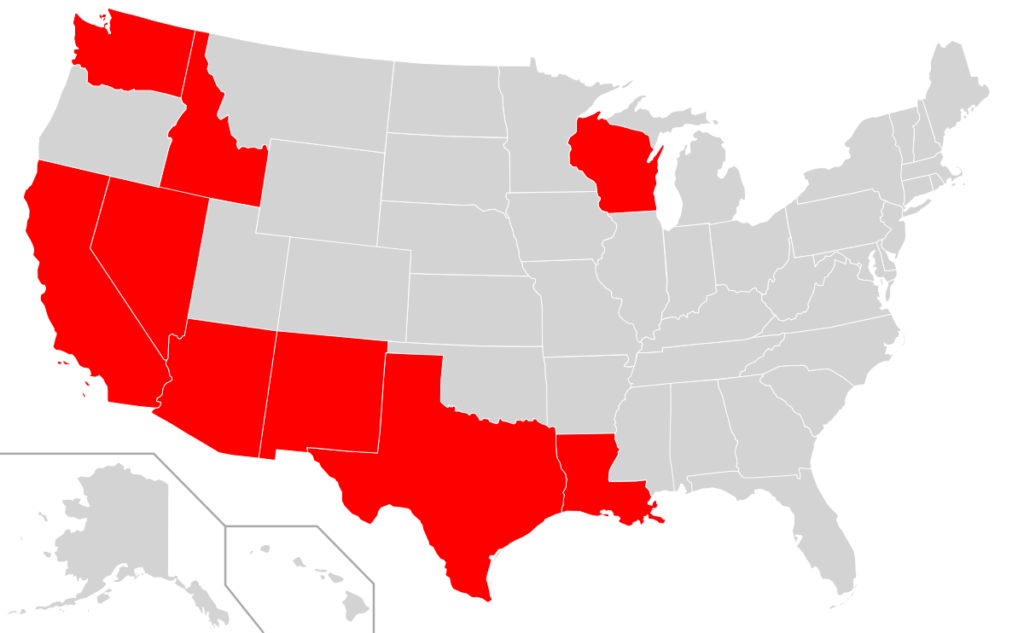

The real surprise for a non-debtor spouse in a community property state, shown here in red.

Bankruptcy law brings all of the community property of the couple into the estate. Not just the half of the community that is allocated to the spouse that filed bankruptcy, but all of the community.

In return for inclusion of all of the community property in the estate, all of the creditors who could have satisfied their claim from community property can be paid through the bankruptcy.

Community claims that aren’t paid in full in bankruptcy are discharged as to the debtor and any future community property. If you are separated when your spouse files bankruptcy, what you acquire after separation is not community property under California law.

Effect of discharge on your debts

Debts that you incurred in your own name (not jointly with your spouse) are not wiped out as a personal liability of yours.

So, after your spouse’s discharge, your creditor can’t collect from community property; the non exempt community property has already been applied to debts. But your creditor can get a judgment and collect from any other assets you have.

As a matter of contract law, your separate property is not liable to a creditor for a debt standing only in the name of your STBX.

Your credit report after your spouse files

By federal law, each individual is supposed to have his or her own, separate credit file. A bankruptcy filing by your spouse should not show as a bankruptcy on your file.

However, debts for which you are jointly liable for, by contract, may have a note in the credit report that the debt was “included in bankruptcy.”

Monitor your credit report so you can challenge any erroneous reporting.

Bankruptcy and the division of property

While all the debtor’s assets come into the bankruptcy estate, exemptions allow debtors to keep certain assets to fund their fresh start. California has two, alternative, sets of exemptions that are comparatively generous.

If your STBX wants to elect the California bankruptcy exemptions rather than the standard California exemptions including the homestead, you need to agree to that choice. Without your agreement, a bankruptcy debtor in this state must choose the standard exemptions.

California law wants to protect the family home above all else, unless the spouses agree that the alternative exemption system is a better deal for the family.

Your rights to a share of exempt property isn’t cut off by bankruptcy. The division of the exempt property remains the job of the family court.

Some assets, like retirement accounts, simply aren’t included in bankruptcy by law. Those assets need to divided in the dissolution.

Your action items for STBX’s bankruptcy

Most bankruptcy filings are straightforward and most debtors do their best to play by the bankruptcy rules. If you are concerned or curious about your STBX’s case, here’s a list of possible to-do’s for you, the non filing spouse.

Get copy of bankruptcy schedules

The schedules should list all the debtor’s assets and all of their debts. They are signed under penalty of perjury, so they may be of future use in family court if there are debts you didn’t know about or assets that are omitted.

Confirm you’re on the mailing list

The court will send notices about significant activity in the case, including entry of a discharge. Make sure you and your family lawyer are on the list.

Let your family lawyer know about the case

Parts of your lawyer’s work is covered by the automatic stay. Make sure to share the news. The schedules are filed under penalty of perjury. If the schedules paint a picture different than the one you know, there may be legal consequences in the divorce.

Review the schedules

Look for any assets that are missing from the schedules. See what exemptions have been claimed. You can notify the bankruptcy trustee or the United States Trustee about significant discrepancies in the schedules.

Check for missing creditors

Bankruptcy discharges only debts of creditors who get notice of the case. Make sure that all the creditors you know about are there on the schedules.

File a claim

If you are owed any support that is unpaid as of the date of filing, file a proof of claim with the court. Only creditors who file a claim can be paid through the bankruptcy. Payment is generally months or more after the case is filed.

Do you need a bankruptcy lawyer

Most likely, you have no need for a bankruptcy lawyer. However, if you are worried, or see major issues with the debt and assets listed in the case, get some input from an experienced bankruptcy lawyer. Timelines are short in bankruptcy cases and good advice can help you see your way forward.

More

How to interview a bankruptcy lawyer

Debts that survive a bankruptcy discharge

Basics of bankruptcy and the available chapters