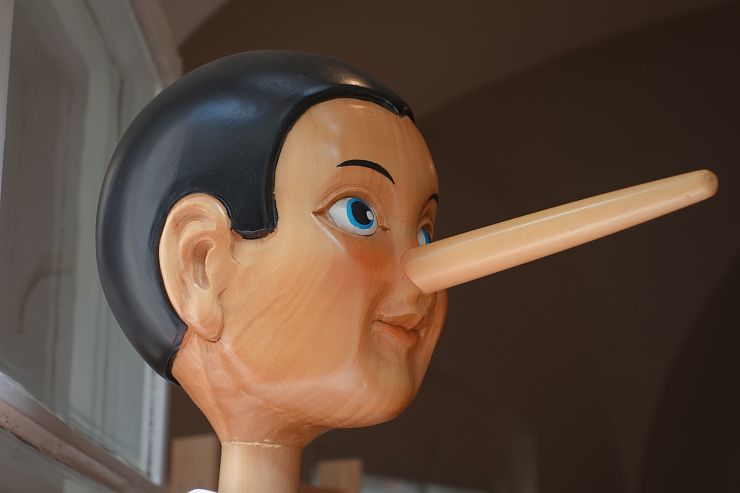

The claim that you lose everything in bankruptcy is, flat out, the biggest lie about bankruptcy. Read anything about Chapter 7 and you get, “Your possessions are sold in Chapter 7 bankruptcy.“

It’s a liquidation proceeding and your stuff will be sold to pay creditors, the lie goes on.

No wonder people are scared off from getting relief from debts they can’t pay.

But in the real world, it’s simply not so: fewer than 3% of all Chapter 7’s result in the sale of any assets, and that includes corporate bankruptcies. (Corporations don’t get to claim exemptions.)

To be clear: the law allows for the sale of non exempt assets. But in the overwhelming number of individual cases, the trustee liquidates nothing: No possessions are sold in bankruptcy

Why no possessions are sold in Chapter 7

The reason no possessions are sold in 99% of bankruptcy cases is a combination of law and economics.

Either:

- Your assets are protected by exemptions.

- Your non exempt assets have no meaningful sale value.

- You picked Chapter 13 where you keep your assets.

The trustee’s job is to determine if there is non exempt value in the debtor’s assets from which a meaningful dividend could be paid to unsecured creditors. The expectation is that secured creditors, those with a lien, can enforce their lien for themselves. Likewise, the taxing authorities can do their own collection.

The trustee must be able to sell an asset, pay himself and the costs of the sale and have a pot of money left to pay creditors before he sells anything.

If he can’t produce meaningful money, he abandons the assets back to the debtor. Often that declaration that a case is “no asset” is issued the day of the first meeting of creditors.

Why the big lie persists

Despite those facts, too many sites on the web intone that in Chapter 7 “your assets are sold to pay creditors”. Such as:

Chapter 7. This type of bankruptcy essentially liquidates your assets in order to pay your creditors….But your remaining, non-exempt assets will be sold off by a trustee appointed by the bankruptcy court and the proceeds will then be distributed to your creditors.

Investopedia

Chapter 7 means the court sells all your assets—with some exemptions—so you can pay back as much debt as possible.

Dave Ramsey

The consequences of a Chapter 7 bankruptcy are significant: you will likely lose property.

Experian

Again, the reasons for the lie are mixed.

Some of these writers are just lazy: they haven’t check the facts about what happens in real cases. Others have a profit motive in scaring people off from an effective means of regaining control of their financial lives.

Get good bankruptcy counsel

Leaving bankruptcy with all the assets you entered with may require planning and advice from a professional. Failure to understand exemptions and what is “property of the bankruptcy estate” is what turns no-lawyer cases into disaster zones.

Note that the third reason that most individual bankruptcy cases are “no-asset” cases is that a good attorney was involved. The attorney either crafted some exemption planning or spotted that assets might be at risk and advised filing Chapter 13.

So, tune out the “you lose everything in bankrutpcy” garbage and get a good attorney to guide you to a fresh start.

More

How to interview a bankruptcy attorney

Chapter 13 keeps you in control