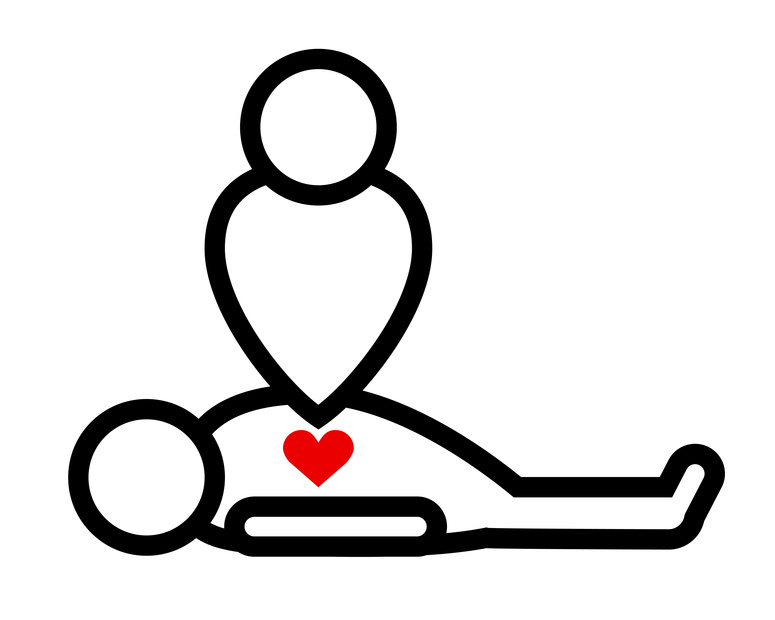

CPR has its place when human life is involved. Human life is precious.

But when what’s dying is the legal right to collect a debt? Not so fast.

You don’t want to breathe new life into an old debt that is legally dead.

Yet you can do that, unintentionally reviving a debt that is legally dead by giving it new life when it’s approaching its life’s end.

California statute of limitations can be tricky. I originally intended in this post to explain the rules around the statutute of limitiations. I wanted to show you how to keep from unwittingly extending your legal exposure to a debt.

I’ve concluded that the law is simply too complicated and evolving to provide a nuanced, reliable guide so you can avoid screw ups.

So, I’m adopting the Nancy Reagan approach to the statute of limitations.

Just Say No!

NO, I don’t owe it.

NO, I won’t pay it.

While it may stretch the truth as to whether you owe it, it’s simple and safe. It keeps you from adding to your exposure to old debts.

Admit nothing.

Don’t extend the statute of limitations

The statute of limitations allows enforcement of a legal right through the courts only if brought before the running of the statute.

- Make a payment

- Admit that you owe it

Important to note that either of these ways of extending the life of a debt are acts that you, the person who owes the money, take.

The debt collector can’t extend the statute unilaterally. Only by getting you to do something against your interests is the life of the debt prolonged. Here’s how they try to do it.

Payment breathes new life in old debt

Making a payment on the account is putting your money where your mouth is: you wouldn’t pay anything if you thought you didn’t owe money.

So payment is seen as proof that you owe the money.

Payment starts the statute of limitations clock running again, from the beginning.

That’s where the debt collector’s request for a “good faith” payment on a debt you can’t pay off at this time is so insidious. The debt collector cares far less about the amount of that “good faith” payment than he does about the fact that you’ve just extended your legal exposure to the debt for an entirely new period. What that period is we’ll discuss below.

Admitting the debt is fatal

An admission that you owe the debt, even without payment, can reset the SOL clock.

However, California law provides that only an admission of the debt in writing can extend the statute:

No acknowledgment or promise is sufficient evidence of a new or continuing contract, by which to take the case out of the operation of this title, unless the same is contained in some writing, signed by the party to be charged thereby, provided that any payment on account of principal or interest due on a promissory note made by the party to be charged shall be deemed a sufficient acknowledgment or promise of a continuing contract to stop, from time to time as any such payment is made, the running of the time within which an action may be commenced upon the principal sum or upon any installment of principal or interest due on such note, and to start the running of a new period of time, but no such payment of itself shall revive a cause of action once barred. Code of Civil Procedure 360.

Yet there are precious few cases on the subject.

And while traditionally, the statute of limitations that applies to any collection suit was the law of the state where the defendant lives, recent cases make that less certain. Topping off the uncertainty, the 9th Circuit Court of Appeals recently ruled that in bankruptcy, the statute of limitations of the state whose law applied to the contract controlled, not the shorter statute where the debtor lived. Sterba

All of which makes saying nothing, or saying no, the safest course of action if you have an old debt that you can’t pay.

Why have a statute of limitations

Pubic policy says we want legal disputes resolved sooner rather than later. If a lawsuit is involved, we want the evidence available and memories fresh.

It’s the legal version of SNOOZE, YOU LOSE.

A collector or a debt buyer has the same statute of limitation as the original creditor.

When does the limitations clock start running

The SOL clock starts running on the limitations period upon the last activity on the account. That activity could be a payment on a debt; it could be a charge on an open account.

If there are neither charges nor payments on a contract after that, the period runs for four years in California.

Once the limitations period has run, the person who owes the debt has a slam-bang winner of a defense if the creditor files a lawsuit to collect.

More from the FTC on time barred debts.

More here on debt collection lawsuits

What to do when you’ve been sued

Fighting back against wage garnishment