The aftermath of mortgage mess mess will be with homeowners for as far into the future as we can see.

Even those who held on to their homes can expect trouble.

The “who’s got the note” theory of foreclosure defense that swept the rest of the country never made much headway in California.

We are a non-judicial foreclosure state. Lenders don’t have to file truthful pleadings in state court in order to foreclose. The lenders got a pass there.

But loan servicing is different.

Lenders, and the servicers they hire to manage their loans, have an obligation under federal law to accurately apply the funds they receive and account for fees they add to the loan.

But, they don’t do a very good job of it.

Far too many servicers haven’t recorded the changes to what the borrower owes by reason of loan modifications.

Their reporting on how much you owe on your mortgage changes erratically from month to month.

And you may never see the fees they’ve added to the loan until you go to sell the house, or they file a foreclosure action.

If you don’t know what they’ve done, how can you dispute it?

New legal tools for homeowners

Things have changed.

Starting January, 2014, homeowners got an expanded tool kit to deal with mortgage servicers.

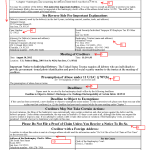

The Qualified Written Request has been joined among the tools provided by RESPA by the Request for Information and the Notice of Error.

The QWR has been with us for years. If you disputed something about the servicing on your home loan, you could ask, and the lender was supposed to respond, for information about the accounting and your dispute with its accuracy.

In my experience, the timelines for answering were too long to be useful.

Lenders made it difficult to find the single address to which a QWR could be sent.

Most responses I got from the servicer were meaningless.

The Dodd Frank Act, passed by Congress as a result of the financial meltdown, included beefed up provisions for getting information about loan servicing.

Notice of Error

If you spot an error with respect to the servicing of your loan, you can issue a Notice of Error to the servicer.

It must be in writing and contain enough information to identify you and the loan.

The regulation lists 10 kinds of errors covered by the NOE, plus a catchall category.

The servicer must acknowledge receipt of your notice in 5 business days and respond substantively in 30 business days.

Here’s the full version of CFR Reg. X 1024.35, the notice of error provision.

Request for Information

Teammate of the Notice of Error in the new RESPA lineup is the Request for Information.

This is the change that sets my heart aflutter. You don’t have to know that there’s a problem to make a Request for Information.

Your request isn’t confined to the servicing of the loan. It extends to information “with respect to the borrower’s mortgage loan”.

That includes information about a loan modification application. And, you can get the identity of the entity that owns your loan.

Here’s the full text of CFR Reg. X 1024.36, the request for information provision.

Annual mortgage checkup

Every homeowner with a mortgage should make an annual Request for Information. Ask for a life of loan history; any charges or fees added to the loan; disbursements made by the servicer; and any escrow balance or suspense balance.

Further, any time that the servicing of your loan changes, make the same request promptly. The former servicer need only respond to your request for a year following the transfer. Historically, the old servicer doesn’t transfer much in the way of information to the incoming servicer. Mistakes become hard to find and hard to correct when not tackled immediately.

Welcome to what I sincerely hope will be a new world of more transparent and responsive mortgage loan servicing.

Image of destroyed houses: FEMA in the public domain.

Image of tools courtesy of Openclipart